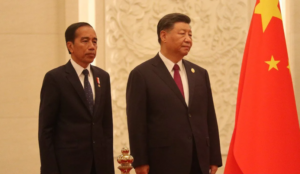

Indonesian President Joko Widodo met with Chinese President Xi Xinping on the sidelines of the 5th Belt and Road Initiative (BRI) Summit in Hong Kong on 17 October.

On 17-18 October 2023 the Chinese Government organised its fifth Belt and Road Initiative (BRI) Summit in Hong Kong. It was a milestone event, commemorating ten years since BRI began in 2013.

Representatives of over 130 countries attended this year’s summit. One notable attendee was Indonesian President Joko “Jokowi” Widodo, accompanied by Minister of State-Owned Enterprises Erick Thohir, Minister for Foreign Affairs Retno Marsudi, and Minister for Trade Zulkifli Hasan.

Jokowi delivered remarks at the summit opening emphasising the importance of mutually beneficial partnerships and the long-term sustainability of projects.

He then continued on to the Indonesia-China Business Forum in Beijing, where he unveiled a host of new investment deals focused on green development. This kind of ‘greenspeak’ was notably absent when BRI began. It’s now an adjective of choice for describing Chinese investment in Indonesia.

But how green is Chinese investment, really?

Indonesia becoming BRI’s golden child

Infrastructure and economic development has been a hallmark of China-Indonesia relations under Jokowi’s tenure. China is now Indonesia’s largest trading partner and second-largest investment partner. According to a 2021 AidData report, it is also one of the largest recipients of BRI funding.

When Jokowi held talks with Chinese President Xi Jinping on the sidelines of the BRI summit, Xi lauded the recently-launched Jakarta-Bandung fast train as a BRI “golden brand”. Certainly, the project is one of the BRI’s highest profile investments, with the two countries now discussing an extension to Surabaya.

Xi also promised support for emerging industries like the digital economy, photovoltaic (PV) solar energy and electric vehicles (EVs). He also called for deeper integration of industrial supply chains through “a regional comprehensive economic corridor”.

At the Indonesia-China Business Forum in Beijing, Jokowi accompanied by 31 private and state‑owned companies from Indonesia and Minister for Trade Thohi, said eleven new investment deals worth US $12.6 billion were signed during the visit. These investments will reportedly focus on the development of EV batteries, green energy and healthcare.

This comes off the back of a major US $11.5 billion investment in quartz sand processing, announced during Jokowi’s last visit to China in July – a vital first step in the development of a domestic PV solar industry.

Green development in the spotlight

Green development was a key area of discussion in the lead-up to the Beijing summit because of growing scrutiny on the environmental sustainability of investments made under BRI.

China has been spruiking a greener BRI since 2019 but some commentators are questioning whether the implementation of BRI investments is contrary to the spirit of green development. For instance, fossil fuel power plants funded under BRI contribute around 245 million tonnes of carbon dioxide per year.

In 2021 the Chinese government said it would stop building new coal fired power plants overseas. But studies have shown as much as 86% of China’s funding for Indonesian energy projects is channelled towards the development of coal-fired power plants through the China Development Bank (CDB) and the China Export-Import Bank (CHEXIM).

Moreover, the BRI continues to investment in the development of captive coal-fired power plants – localised power generation capabilities for discrete industrial projects.

One such project is the development of a 4×380-megawatt coal power plant on Obi Island in North Maluku. This joint venture between Lygend from China and Harita Group from Indonesia will power local nickel smelters. This is significant in the Indonesian context because Jokowi’s administration has emphasised foreign investment in industrial projects, particularly energy intensive nickel smelters, to help Indonesia capture more downstream value from its natural resources

Beyond emissions, many projects have other social and environmental costs, especially nickel smelters, which rely heavily on foreign labour and often pollute the surrounding natural environment. For instance, reports have shown operations at the Morowali Industrial Park – the centrepiece of the Indonesian nickel industry – have turned seawater black from excess coal deposits flushed into the sea by rain.

More accountability needed for green investments

Jokowi’s appearance at the BRI Summit highlights Indonesia’s increasing reliance on China for funding a just energy transition.

On the one hand, Chinese investment is paving by the way for the development of local electric vehicle and PV solar manufacturing capabilities. This can accelerate both Indonesia’s economic development and clean energy transition. But on the other hand, the social and environmental costs of these investments are mounting.

China needs to do more to ensure its BRI investments are transparent, do not damage the environment, and do not harm local communities or workers. Complaint mechanisms for affected communities also need to be clear.

The Indonesian government needs to better stipulate social and environmental requirements when attracting green investment from international partners and be firm in upholding these requirements. It also needs to be more selective in choosing industrial projects that can keep its carbon emissions moving in the right direction – down. Instead, the controversial omnibus laws introduced in 2020 weakened environmental protections and safeguards.

Local communities and civil society organisations need to hold all parties accountable. This will not be easy. Greenspeak is now firmly established in the rhetoric of modern economic diplomacy, and it is getting harder to differentiate clean green deals from the dirty ones.

https://www.antaranews.com/foto/3778404/presiden-jokowi-disambut-upacara-kenegaraan-di-china/2

https://www.antaranews.com/foto/3778404/presiden-jokowi-disambut-upacara-kenegaraan-di-china/2

https://www.antaranews.com/berita/782688/rhoma-irama-siap-meriahkan-perayaan-tahun-baru-di-monas

https://www.antaranews.com/berita/782688/rhoma-irama-siap-meriahkan-perayaan-tahun-baru-di-monas